With a 15.4 per cent compound annual growth rate (CAGR) forecast over the next 5 years, the Australian security appliances market is recording its best growth ever.

As outlined in the IDC Australia Security Appliance Tracker, the 2014 value for the Australian security appliance market reached US$191 million.

During the next five years the security appliance market is expected to accelerate by 15 per cent year-on-year (YoY) growth each year, reaching US$390.5 million by the end of 2019.

The Australian security appliances market is expected to grow slightly faster than other mature markets in Asia Pacific, but less strongly than 'developing countries of Asia Pacific', which includes India, Indonesia, Malaysia, the Philippines, the People’s Republic of China, Taiwan, Thailand and Vietnam.

Australian appliances market in Asia Pacific. The size of the bubbles represents the size of the market in USD. Source: IDC Asia-Pacific Quarterly Security Appliance Forecast, 2015.

The strong pick up in security appliances in Australia between 2014 and 2019 is partially due to the fact the country is one of the largest targets worldwide for cybercrime, easily accessible through the English language and with a relatively healthy economy. Compliance requirements also positively affects spending.

Although most expected the security appliance market to shrink, Australia is still experiencing strong adoption.

Technology buyers are either complementing their existing installation or purchasing a 'start-off kit' to comply with legal and regulatory security requirements.

Content management, UTM

The most popular security appliances in 2014 were content management and unified threat management (UTM).

Content management was the fastest growing appliance in Australia, with 16 per cent YoY growth in 2014.

The trend is expected to continue as the product category is forecast to grow at a 18 per cent compound annual growth rate (CAGR) between 2014 and 2019, reaching a 23 per cent market share by 2019.

Although it experienced a slower growth rate in 2014, compared to previous years, UTM appliances will be the largest and fastest growing category, forecast to grow at a 22 per cent CAGR between 2014 and 2019.

UTM now represents 43 per cent of the total security appliance spending, and is expected to exceed 50 per cent value share of all vendor revenue in the country as early as 2017.

With a fast-evolving threat landscape and Australia being one of the top target countries for attackers, Australian companies must invest in security to protect their intellectual property and other assets. This investment needs be strategic and will primarily be targeted at protecting the network and sensitive data through a combination of integrated solutions.

Australian security appliance market, 2014-2019. Source: IDC Australia Quarterly Security Appliance Forecast, 2015

Cisco takes top position

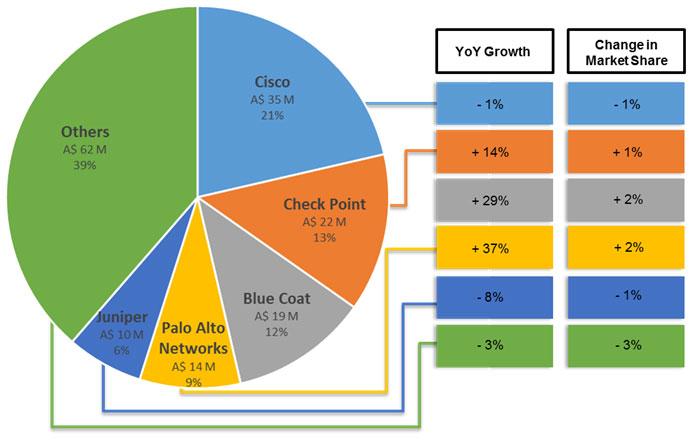

Cisco secured the top position in 2014 on the overall security appliance vendor market with 21 per cent market share by value.

Check Point and Blue Coat had a good run at closing the gap with the Cisco and ended the year with 13 per cent and 12 per cent market share, respectively.

Over the last four years Check Point and Blue Coat have been increasing pressure on Cisco and inching closer to the leading position in Australia.

However, Cisco is fighting back. The company recently announced, at the Cisco Live event in Melbourne, a change in its strategy to provide end-to-end solutions, which will add an additional layer of value for its competitors to attempt to match.

Check Point is having a lot of tractions in the Australian market, and its dominance in unified threat management will help grab additional market share in the overall security appliances market in the next five years.

In the past couple of years, Blue Coat has been struggling to define its new strategy in the Australian Market. However, the company had a very strong quarter in 2014Q4, and the recent purchase of the company by Bain Capital will help the security vendor find reconfigure its strategy to evolve with the new threats landscape.

Top 5 Vendors, Australia Security Appliance Market Share and Value, 2014. Source: IDC Australia Quarterly Security Appliance Tracker, 2014

The market is now dividing into two: Vendors that provide a complete security suite thanks to in-house capabilities or investments, and those who partner to provide their customers with a suite composed of best-of-breed products.

It would thus not be surprising to hear about future alliances such as the newly announced one between Check Point and FireEye.

IDC's Australia Quarterly Security Appliance Tracker offers the ability to quickly and effectively respond to today's dynamic security server appliance market by keeping pace with evolving functionality and the rapid deployment of new models competing in the marketplace.

Lydie Virollet is an IDC associate market analyst. Her personal area of focus is infrastructure software (storage software, security software and appliances, system network management software and systems software).